The 5-Second Trick For Paul B Insurance

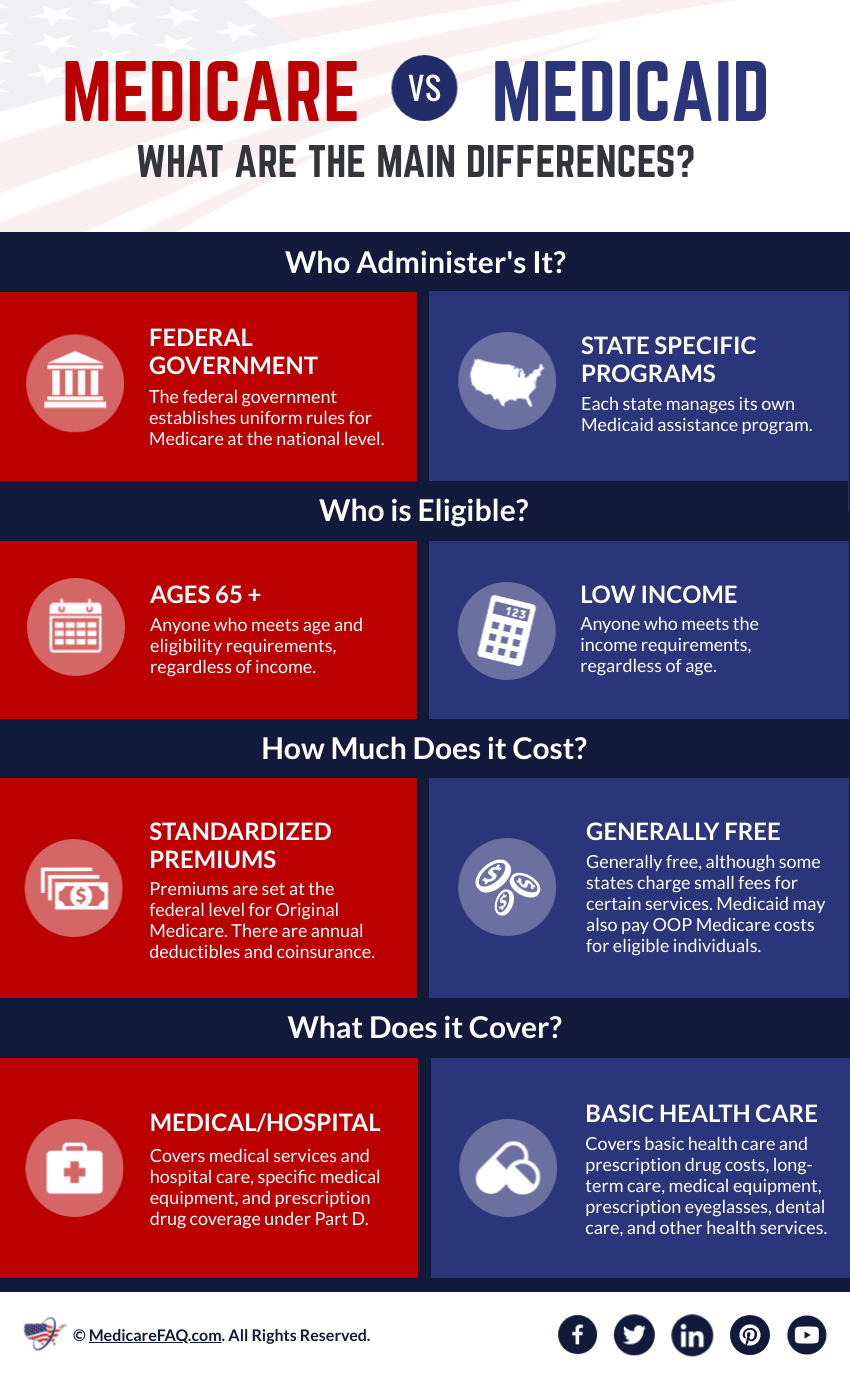

Individuals in Medicaid expansion states have greater rates of diabetic issues medical diagnoses than those in states that did not increase. They get a lot more timely, and therefore much less challenging, care for 5 typical medical conditions. Medicaid development is related to accessibility to prompt cancer cells diagnoses as well as therapy.11,12,13,14,15 Coverage enhancesaccessto behavioral wellness and also substance make use of disorder therapy. By 2016, 75 %of Medicaid enrollees with OUD filled up prescriptions for medication therapy. Protection diminishes expense obstacles to accessing care. Less people in states that increased Medicaid record price as a barrier to care than those in states that did not broaden Medicaid, and less people in expansion states report missing their medications as a result of cost. Coverage expansion is related to decreases in mortality.

After Massachusetts carried out insurance coverage growth with both Medicaid and exclusive coverage, the all-cause death rate in the state decreased considerably. Medicaid development is connected with lower cardiovascular death particularly. Much more individuals in development states gave up cigarette smoking, consistent with Medicaid protection for preventative care as well as evidence-based smoking cessation solutions.28, A study of Oregon's earlier growth discovered that individuals that became eligible for Medicaid experienced reduced rates of depression than those who did not. Insurance policy standing also differs by race as well as ethnic background. Hispanics have overmuch high prices of being without insurance, as compared to non-Hispanic whites. The high rate of uninsured puts stress and anxiety on the more comprehensive healthcare system. Individuals without insurance coverage avoided required treatment as well as rely a lot more heavily on health center emergency divisions, causing limited resources being routed to treat conditions that frequently might have been protected against or handled in a lower-cost setting. Domiciliary Treatment -It covers the treatment that is taken in your home under clinical guidance. However, there is a limit on the quantity and also the number

of days for which the benefit is given. Ambulance Cover-The costs sustained on availing an ambulance because of a clinical emergency situation are covered under the health insurance. 2. Cashless Cases -With this facility, the insurance firm will certainly resolve the insurance claim amount straight with the medical facility and also you will not have to pay for the hospitalisation. Nevertheless, you should seek treatment at one of the network healthcare facilities related to the insurance company to enjoy the cashless facility. 3. Alternative Treatment -Many medical insurance companies cover alternate therapies such as Ayurveda and also homoeopathy, providing insurance holders another treatment choice. Do not neglect to go through the sub-limits and terms pointed out in the plan. Daily Medical Facility Cash-The daily health center cash money function uses monetary aid to take treatment of other hospitalisation costs that aren't covered under the strategy.

Paul B Insurance for Dummies

Attendant Allowance-Health and wellness insurance policy prepares in India provide an attendant allowance to those adults that go along with the policyholder for the treatment. It is perfect for individuals who secure the whole family under one plan with family members floater plans. You can make use of the advantages of wellness insurance for self, spouse, children, or parents, as per the plan terms.

The 25-Second Trick For Paul B Insurance

name suggests, a health insurance coverage policy is one that manages the health of an individual. The benefits of having medical insurance are numerous. To choose a perfect one, you must understand that there are various means in which insurance plans work. Some medical insurance service providers repay the entire quantity which was utilized for the treatment, and also some provide cashless therapy services. If the policy uses cashless treatment, after that the patient will not need to pay any kind of quantity to the healthcare facility as the insurance coverage will certainly cover the entire cost. Paul B Insurance. Therefore, recognizing medical insurance is very important before settling one. The majority of organizations provide medical insurance to their staff members and their dependents. Nonetheless, if you take place to leave the company, you will certainly not have the ability to make use of the plan. If you are preparing to leave your organization to do your own business, as well as so on, you have More Help to

get an obtain insurance policy for plan and your family. Yearly you have to renew your policy by paying the premium. While selecting, you have to go for the one that offers maximum choices and also comes with a practical premium. As soon as you buy one, you will be able to experience the advantages of having medical insurance whenever the need emerges. You can take a look at the policy as well as the protections that are consisted of to know article the benefits of having health insurance policyfrom Cigna. If you want to put even more alternatives, you can do so also. Currently, if you are an employer and also you are looking out for a plan for your employees, after that you can look into the strategies used by Cigna. Below are a few guidelines on just how a medical insurance functions, however theycan vary based on the chosen health and wellness insurance policy strategy and also the medical facility: The amount guaranteed or the quantity of coverage of a wellness insurance policy plan is the optimum quantity imp source that you can assert from a wellness insurance coverage company for the medical expenditures, which may include health exam, in-patient hospitalization, laboratory tests, pre-as well as post-hospitalization costs, surgical treatment, rehabilitation, and so on. The core advantages of a medical insurance strategy are the benefits that you can claim from the first day. Some wellness insurance policy strategies might come with a waiting duration for some pre-existing problems, maternity claims, etc. If there is a particular waiting period for a treatment or a claim, after that the insurance policy protection for that benefit will certainly start upon the completion of that period. Some medical insurance coverage strategies

may have an insurance deductible. A deductible is an amount that you need to pay out of your pocket, after which your health insurance plan begins to pay for your healthcare-related expenditures. Prior to obtaining the very best health and wellness insurance coverage plan, it is important to know the significance of medical insurance policy along with its terms as well as problems. The advantages of having healthinsurance policy are numerous. To select a suitable one, you need to know that there are different methods in which insurance policies function. Some medical insurance carriers reimburse the whole amount which was utilized for the therapy, and some provide cashless treatment solutions. If the plan offers cashless therapy, after that the patient will not need to pay any type of total up to the health center as the insurance policy will certainly cover the entire price. Because of this, understanding wellness insurance is essential before settling one. A lot of organizations offer medical insurance to their employees as well as their dependents. Nonetheless, if you happen to leave the organization, you will certainly not have the ability to make use of the plan. If you are intending to leave your company to do your own service, and so on, you have to get a health and wellness insurance coverage plan for you and also your family.